Part of the beauty of modern ATMs is how elegantly simple they seem from the outside. The simple, user-friendly interface includes a touch screen, a card reader, a slot for deposits, and a slot for withdrawals. Of course, there’s more to these machines than meets the eye of the customer. Behind this sleek facade, you’ll find a computer running complex software, a safe for deposits, and a combination safe/dispenser that can accurately provide the requested bills to the user.

Here’s a brief explanation of how ATM cash dispensers work from the experts at Hyosung America.

Cash Dispensers in ATMs

Cash dispensers are a central feature of ATM machines. They are responsible for giving out cash, which is the main reason why your customers will visit your ATM. Dispensers have different storage areas for different denominations. When cash is requested, rubber rollers peel off bills one at a time. Sophisticated scanners check to make sure bills are of the correct denomination, and that two bills aren’t stuck together.

The dispenser itself also doubles as a safe, which keeps your cash reserves secure. By providing security, keeping an accurate count of money withdrawn, and requiring little maintenance, modern ATM dispensers help keep your fleet operating at maximum efficiency.

High Capacity for High Volume Areas

Though all ATM cash dispensers serve the same general purpose, there are plenty of differences between models. One of the biggest differences is capacity. Higher capacity ATMs generally cost a little bit more to purchase, but the reduced cash handling expenses will quickly make up for a larger initial investment.

High volume settings, like popular tourist areas, busy shopping centers, and certain bank branches might benefit greatly from upgrading to high capacity models. Space, however, is an issue too. Lower capacity ATMs generally have a smaller footprint, which may be a necessity.

Recycling ATMs: A Next-Gen Solution

The next generation of ATMs features recycling capabilities. The dispensing cartridge in a recycler is capable of accepting deposits into the dispensable cash reserve. This means it will replenish itself from customer cash deposits, which can drastically cut down on money handling expenses. Locations that receive a lot of deposits are prime candidates for an upgrade, while locations that primarily dispense cash are probably fine with traditional dispensing technology.

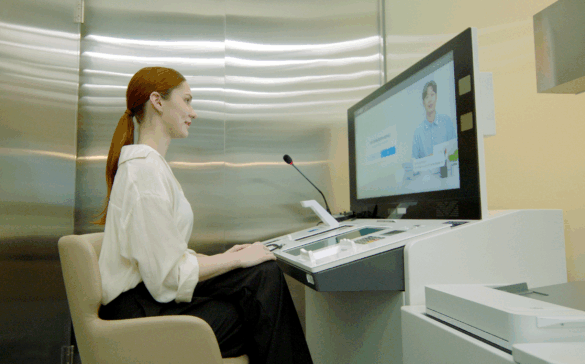

Work With an Industry Leader

Hyosung America has deployed tens of thousands of ATMs across the U.S., Canada, and Mexico. In addition to ATM machines, we’ve also outfitted thousands of bank branches with teller cash dispensers, which use similar technology to make your employee’s job much easier. We have the experience you need to improve and expand your ATM network or transform your brick and mortar bank branches. If you have any questions about the latest cash-dispensing ATMs, please contact us today.