Cash is Still King – But Smarter Management Is Now a Must

Cash remains central to many retail and hospitality venues across Australia and New Zealand. From the gaming floor to the bar, it’s still the preferred form of payment for many patrons. But behind the scenes, managing that cash comes with significant operational complexities – manual counting, float preparation, reconciliation delays, and ongoing pressure to maintain security and compliance. And layered on top of this are rising labour costs, insurance premiums and tighter regulatory expectations.

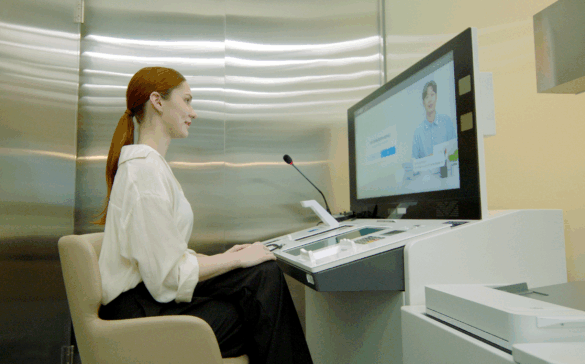

This is why more venues are turning to automation – and at the forefront of this are Retail Cash Recyclers (RCRs) – purpose-built cash management solutions designed to simplify venue operations, reduce costs, and give staff back valuable time.

Designed by Hospitality Venues, for Hospitality Venues

These Retail Cash Recyclers were designed in close consultation with some of our largest hospitality clients to directly address the real challenges faced in high volume, cash heavy environments. It automates the full cycle of cash handling – counting, storing, dispensing and reconciling both notes and coins – freeing up your team from the manual tasks that slow operations down.

Whether it’s float automation for tills, ATMs, Cash Redemption Terminals (CRT) and Cashiers, these Retail Cash Recyclers handle it all efficiently and securely. And with more than 260 venues across Australia and New Zealand already using our Retail Cash Recyclers, the benefits are being felt on the ground.

That kind of operational shift is only possible because our Retail Cash Recyclers combine intelligent automation with industry-specific functions:

- The fastest float and clearance automation on the market

- The largest available cash capacity – 15,000 notes and 16,000 coins

- An insurance-rated UL291 safe, with secure cloud-based data storage

- Real-time visibility and remote access for both operational and finance teams

- Same-day fund transfers and settlement to your nominated bank account

Time Saved, Productivity Gained

Manual cash handling places a heavy burden on staff time and operations. Venues using our Retail Cash Recyclers report significant reductions in repetitive tasks like float preparation, counting and reconciliation – freeing up teams to focus on higher-value responsibilities.

“The Retail Cash Recycler is saving up to 50 hours per week in manual cash management across our whole operation, which equates to up to $2,100 per week in labour savings. We can easily just have one manager doing the open now instead of having two.” (Paul Stansfield – Operations Manager, Lions @ Springwood, Queensland).

Results may vary by venue size and cash volume, but what remains consistent is the impact: less time on manual processes, and more time where it counts.

Smarter Cash Security, Simpler Reconciliation

Security and compliance are the backbone of our Retail Cash Recycler’s design. With unique logins for each employee, every Retail Cash Recycler transaction is traceable – and withdrawal limits, duress alarms and counterfeit note detection help reduce risk. Automated daily settlements and reconciliation tools give management clear oversight, while also supporting Anti-Money Laundering (AML)/Counter-Terrorism Financing (CTF) and audit requirements.

“The Retail Cash Recycler’s security features and cash counting accuracy make it a vital part of our operations. At the end of each trading day, knowing our cash is locked away and off the gaming floor gives us real peace of mind.” (George Ramia – GM, The Sphinx Hotel, Victoria).

Whether you operate one venue or many, the result is the same: fewer errors, more control, and greater confidence in your cash management systems.

The Future of Cash Management Is Already Here

Cash will always be part of gaming, but it doesn’t need to be a burden. With the right cashing automation in place, venues can reduce complexity, improve security, and free up their teams to focus on what really matters.

Hyosung and Next Payments are committed to helping our clients streamline their cash management processes – backed by in-house innovation, industry knowledge and a genuine focus on client outcomes. The future of cash handling isn’t on the way – it’s already here. And with our Retail Cash Recyclers and our suite of technologies, it’s already delivering results for hundreds of venues across Australia and New Zealand.

See the RCR in Action at AGE 2025

If you’re heading to the Australasian Gaming Expo (AGE), held from Aug 12th to the 14th , we invite you to experience our Retail Cash Recycler for yourself at Next Payments’ stand 240.

Whether you operate a club, hotel, pub or casino, our team will help you picture what daily operations could look like with a Retail Cash Recycler in place at your venue – and just how much time, pressure and risk it can take off your staff and management.

As many of our clients say, the Retail Cash Recycler offers real peace of mind. Think faster reconciliation, fewer errors, better staff productivity, stronger compliance, and a level of visibility and control that will transform venue operations like no other. Can’t attend the event? No problem. Contact Hyosung or, if you’re in Australia or New Zealand, Next Payments to see how we can improve your cash management operations.