As the ATM and cash landscape continues to see drastic change and digital banking accelerates, the role of the ATM is being fundamentally reexamined. Once viewed as a simple transaction device, the ATM is now positioned to evolve through the application of artificial intelligence (AI) into a strategic extension of the bank’s digital and physical channels. AI enables ATMs to move beyond static, rule-based operations and respond intelligently to operational, security, and customer interaction challenges. This transformation is not incremental but structural, redefining how ATMs are managed, secured, and experienced by users. The most immediate and measurable impact of this shift begins with how AI reshapes operational efficiency through predictive, data-driven management.

Maximizing Operational Efficiency: Predictive Operations

In traditional ATM operations, the largest costs come from Cash-in-Transit (CIT) and maintenance. With AI, financial institutions can deploy precise optimizations to improve these areas.

By analyzing historical transaction data, nearby events, and seasonal fluctuations, AI can predict the optimal cash balance for each machine in real time.

This minimizes idle cash and reduces replenishment frequency, dramatically lowering operating costs.

Recently, CIT costs have been significantly improved through cash recycling technology, but this has also caused cash demand forecasting to actually become more difficult. Due to the increased volatility—such as denomination imbalance issues and more complex deposit/withdrawal patterns—the need for AI-based approaches to ATM operations has grown beyond what traditional statistical methods can handle.

Advanced AI can also analyze subtle sensor-level changes in hardware to trigger or alert to maintenance before device failures occur. This increases uptime and enables more accurate root-cause prediction during incidents, allowing issues to be resolved in a single visit and significantly reducing maintenance costs brought on by repeat dispatches.

However, it’s important to remember that ATMs operate under strict network security and bandwidth constraints. As a result, sending all data to the cloud for processing is inefficient. For ATMs, a hybrid architecture that applies edge-based AI technologies is essential.

Evolution of ATM Security: Real-time Behavioral Analysis

Beyond traditional physical security or basic anti-skimming measures, AI also enables highly advanced defense mechanisms at the software level. These include AI-vision based security features and the detection of abnormal behavior, either on the part of the device or the end-user.

Using ATM cameras, AI vision technology can detect attempts to install skimming devices in real time and prevent crimes before they occur. Utilizing the hardware already on the ATMs in this new manner helps safeguard end-users from potential fraud while shoring of the ATM’s security. In fact, Hyosung has deployed these technologies in markets where banks have seen a marked decrease in skimming related crimes.

AI can also be utilized in other ways to deter criminals. For example, when behavior deviates from a user’s typical transaction patterns, AI can strengthen authentication in real time or block the transaction altogether. This can be applied at the ATM switch or terminal handler level and is necessary at the ATM level to further enhance security.

Advancing the Self-Service User Experience

From a development perspective, enhancing the user experience through new AI or other new technologies is both the most challenging and the most promising area.

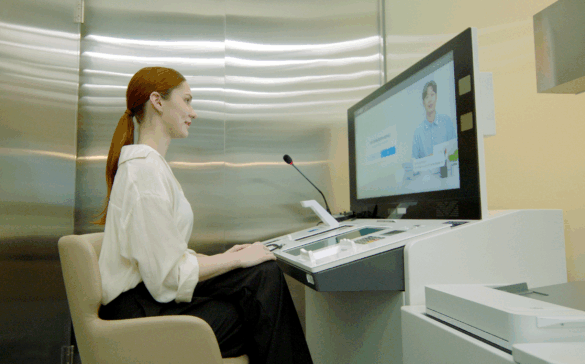

One of the more practical applications of AI we’re seeing to improve the customer experience at the ATM is through conversational interactions. Instead of navigating complex menus, customers can use generative-AI-based voice interfaces to operate branch transformation solutions such as Smart Teller Machines (STMs) or our Digital Desk. This significantly improves accessibility for digitally underserved populations and improves the general transaction flow and convenience to the user.

Personalizing the banking experience is another key area where AI is making great strides. From the moment a customer inserts their card, AI can analyze their frequently used transactions (e.g., $500 transferred on the 25th of every month) and displays them on the initial home screen. Through integration with the bank’s CRM system, highly personalized services can also be delivered to create a much more tailored experience.

Ultimately, the greatest impact AI will have is redefining the value of ATMs. In an era of changing cash usage, AI is transforming ATMs from simple machines into front-end AI agents of the bank, making them a core asset that preserves and strengthens customer touchpoints for financial services.