When it comes to modern banking hardware, cash recyclers are some of the most important assets in your branch. By using these machines, as well as cash recycler ATMs, you can cut down on time-consuming trips to the vault and keep your tellers working at peak efficiency. The latest cash recycling machines can sort bills so quickly, it almost looks like magic. These specially engineered devices can take a stack of cash from a customer and count and sort it in a mere instant.

Read more as the experts at Hyosung Innovue explain how cash recyclers work.

Cash Is Inserted

When a customer wants to deposit cash, you simply place the stack of bills in the bill tray and use the touch screen to begin counting. Small wheels whisk bills through a narrow slot where they move on to the next stage of the process. Some recyclers intake bills more rapidly than others, but even the slowest machine is much faster than a person.

Cash Is Counted

As bills enter the machine, they pass over a scanner that can accurately read their denomination. This scanner can also identify bills as being either counterfeit or foreign and route them towards a non-acceptable currency holding area. As bills are being scanned, the machine calculates the deposit total, including a breakdown by denomination. With the latest software integration, your customer’s account can be updated in real-time.

Bills Are Stored in Cassettes

Bank cash recyclers store cash cassettes inside a built-in safe. When a teller needs more cash for their drawer, they can simply remove cash from the machine in an automated fashion. This can dramatically cut down on trips to the vault, which is relatively labor- and time-intensive. By recycling bills from the TCR, you can improve employee efficiency and reduce wait times for your customers.

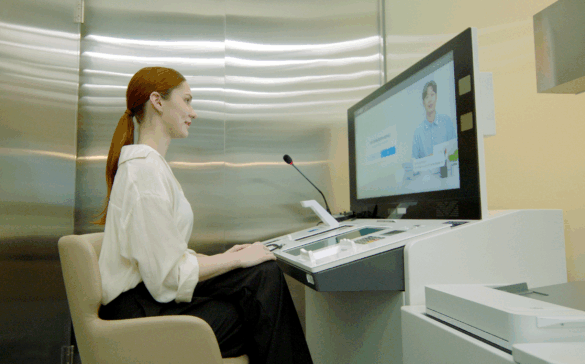

Cash Recycling ATMs

Cash recycling ATMs are designed to both accept and distribute bills and have been estimated to lower cash handling expenses by nearly half. Recycling ATMs also cut down significantly on the time and expense of cash transportation, ATM downtime, and idle cash sitting in the machine. They require less refilling since they reuse bills that have been deposited by customers. Recycling ATMs reduce labor and cost, and increase efficiency and accuracy with immediate results.

Transform Your Branch

Though more and more banking transactions can be done online and at remote ATMs, branches are essential locations where customers and businesses can deposit or withdraw large amounts of cash, or discuss loans, mortgages, and other transactions that often require a personal touch. By transforming the cash deposit/withdrawal aspect of your branch with the latest hardware from Hyosung Innovue, you can not only improve efficiency in the branch but also make visiting a branch more streamlined and enjoyable. Contact us today to discuss our leading-edge bank cash recycler solutions and to learn how you can keep your branches thriving in these changing times.