Cash recycling ATMs are similar in many ways to traditional ATMs, so is there really a benefit to upgrading the hardware of your branch and remote network? The answer is a resounding “yes.” Cash recycling, performed by teller counting machines and ATMs, offers several advantages over standard banking hardware.

Reduced Cash Handling

For starters, cash recycling solutions are aimed at limiting the amount of time and labor consumed by handling cash. Since a recycler has the ability to count, sort, and store cash for later use it eliminates a majority of manual cash counting and handling, which in turn increases an organization’s operational efficiency. When used in an ATM, cash recycling allows reduces the frequency of replenishments, which creates a significant cost savings opportunity for financial institutions.

Additionally, you can reduce the amount of “idle” cash in your network and optimize your FI’s cash transit strategy, which further saves on labor and decreases downtime. Another advantage is that teller recyclers from Hyosung TNS use cassettes that are interchangeable with modern recycling ATMs, which means a branch ATM can be refilled quickly by a teller. It’s another benefit that ensures your ATMs will stay ready for use around the clock.

Improved Security

Less cash handling means increased security. With cash recycling, money spends less time in transit and more time secured in the interior safe of your ATM machine, or behind the teller’s counter. Providing a security detail while refilling remote machines is costly, so by extending the time between refilling machines, you can cut down on this cost as well.

A Better Customer Experience

Saving time, labor, and overhead is great news for branch managers, but for your customers, what really matters is that your ATM is online and ready to process any transaction. In addition to cutting costs, it also pays to keep your customers happy, which means making the cash deposit and withdrawal experience easy, versatile, and available.

A cash recycling ATM from Hyosung TNS features a modular design that makes maintenance incredibly fast. A technician simply needs to swap out one module for another, no manual on-site repairs are needed. Combined with the ability to recycle cash and accept cash cassettes from a teller’s counter, this means your ATMs will be open for business with only negligible downtime for servicing and refilling.

A Streamlined Branch Experience

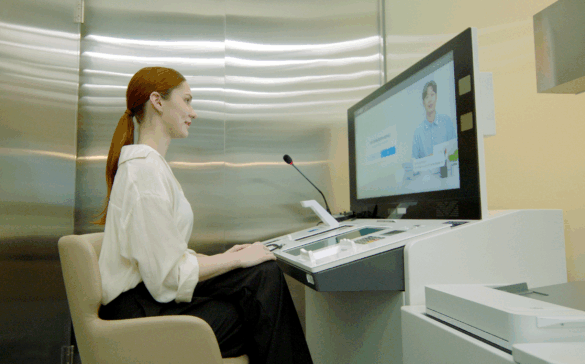

As branch transformation solutions, recycling ATMs are a must. They’re ideal for managing customer flow through a busy branch. After all, the aim of branch transformation is to make a physical trip to the bank as simple and quick as an app-based or online-based transaction. State-of-the-art cash recycling ATMs can perform a variety of transactions. Add in video-assisted transactions, and there’s virtually no everyday transaction that can’t be accomplished with these machines.

Partner With an Industry Leader

An industry leader with tens of thousands of ATMs deployed in branches and remotely across the globe, Hyosung TNS already has a wealth of experience with cutting-edge cash recycling technology. We know what it takes to update the branch experience to meet the needs of a modern customer base, and we have the hardware to make it happen.

If you’re interested in transforming your business, discover more cash recycling information from our experts, or contact us today.