Video Enabled Solutions

Hyosung TNS’s video enabled solutions are the premier way to empower both your teller workforce and the end-consumer all at once. These solutions allow financial institutions to unlock the full potential of their teller line by providing these services to multiple branches at once from a single centralized location. Whether it’s a video enabled ATM or our patented Digital Desk, financial institutions now have more options when it comes to providing consumers with an exceptional banking experience.

Video Enabled Solution

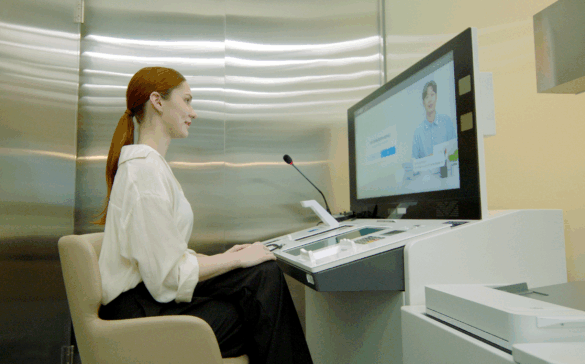

Digital Desk

The next generation in service accessibility

The Digital Desk™ is meticulously designed with a focus on integrating a wide range of cutting-edge solutions, innovative services, and advanced technologies, all curated to empower and facilitate immersive and streamlined phygital banking experience.

Related Experiences & Products

Banking Experiences – Designed for Branches

Explore our full range of customer experiences catered towards bank branches.

ATMs & Kiosks – Designed for Branches

Discover more ATM and kiosk products designed specifically for bank branches.

Related Contents

Redefining Next-Generation Branch Innovation: Self-Service Technology

Bank branches have long been established as a representative channel for financial services. However, the spread of digital banking and changes in customer behavior, expectations, and approaches are redefining the role of physical branches. Unique functions such as complex financial consultations, document processing, and large cash transactions are difficult to fully replace with digital channels, […]

Shared ATMs – A New Model for Europe

Shifting Branch and Cash Landscape Europe The French banking landscape has shifted dramatically in recent years. According to recent surveys, the closure of bank branches is accelerating throughout France and much of the world. When asked, the primary reason cited by financial institutions is the drop in footfalls and the rise of digital banking. In […]

How Gaming Venues Are Driving Efficiency, Security and ROI with Retail Cash Recyclers

Cash is Still King – But Smarter Management Is Now a Must Cash remains central to many retail and hospitality venues across Australia and New Zealand. From the gaming floor to the bar, it’s still the preferred form of payment for many patrons. But behind the scenes, managing that cash comes with significant operational complexities […]