FEATURES

HIGH AVAILABILITY

The 5T is designed to provide reliability that is unequaled in the market, with minimum maintenance and maximum uptime.

HIGH CAPACITY

The 5T has high capacity, cash dispense capability and the ability to support large volume transactions.

FLEXIBILITY

Designed with an open architecture platform, the 5T allows for easy future upgrades and module modifications.

FUNCTIONALITY

The 5T’s expanded functionality includes bill payment and funds transfer, in a highly user-friendly interface, for maximum convenience.

Full Specifications

- Safes: UL 291 Level 1

- Alarm – Seismic + Heat

- Locking Device – Electronic Safe Lock, KABA Mas Cencon (optional) Security camera

- 3.1″ Graphical Thermal Receipt Printer

- Temperature: 0°C~ 40°C (32°F ~ 104°F)

- Humidity 25% ~ 85%

- Height: 1,770mm (69.7”)

- Width: 600mm (23.7“)

- Depth: 1,100mm (43.1”)

- Weight: 541kg (1192.7lbs)

- Rear access

- State of health indicators across all modules

- 19” TFT LCD

- Input Method – IR touch screen

- Privacy Filter

- PIN Pad – PCI compliant

- ADA Audio Guidance –earphone jack

- Card Reader – DIP, EMV compliant

- Microsoft Windows® 10

- Cash Dispenser

- Maximum fill level 346mm per cassettes

- Configurable denomination

- Up to 5 cassettes

- Reject and retract capability

- Dispense up to 50 notes per transaction*

- Communication – TCP/IPHeater optional

- Privacy filter

Related Products

Hyosung 5L (MX5800)

The 5L allows for complete deployment flexibility and a broad range of non-traditional offerings. The 5L is ideal for in-branch or off-premise deployments, and offers the best in class solution when high availability, security, and high capacity are required.

Related Experiences

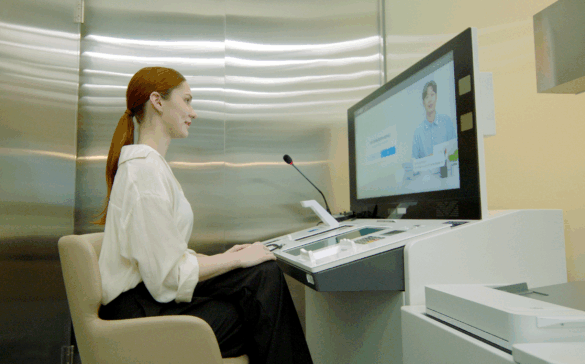

Banking Experiences Designed for Branches & Stores

Elevating the financial world by enabling more efficient operations and convenient services with our best-in-class ATMs and self-service solutions.

Self-Order & Checkout Experiences

Reimagining human experiences at self-order and self-checkout moments, so they are more fluid, more seamless, and more equitable.

Related Contents

Redefining Next-Generation Branch Innovation: Self-Service Technology

Bank branches have long been established as a representative channel for financial services. However, the spread of digital banking and changes in customer behavior, expectations, and approaches are redefining the role of physical branches. Unique functions such as complex financial consultations, document processing, and large cash transactions are difficult to fully replace with digital channels, […]

Shared ATMs – A New Model for Europe

Shifting Branch and Cash Landscape Europe The French banking landscape has shifted dramatically in recent years. According to recent surveys, the closure of bank branches is accelerating throughout France and much of the world. When asked, the primary reason cited by financial institutions is the drop in footfalls and the rise of digital banking. In […]

How Gaming Venues Are Driving Efficiency, Security and ROI with Retail Cash Recyclers

Cash is Still King – But Smarter Management Is Now a Must Cash remains central to many retail and hospitality venues across Australia and New Zealand. From the gaming floor to the bar, it’s still the preferred form of payment for many patrons. But behind the scenes, managing that cash comes with significant operational complexities […]