FEATURES

EASE, CONVENIENCE, AND SPEED

No card. No queue. Simply cash. Mobile ATM transactions involving one-time codes are the easiest cash access. The customer simply pre-orders cash on mobile app, finds the nearest ATM and taps the smartphone against a QR code-based or NFC-enabled contactless card reader on ATM for cash withdrawal. Every transaction will be automatically restored in the smartphone therefore they are readily traceable.

ENHANCED SECURITY

MoniValue100 eliminates security risks related to lost or stolen cards or incidence of skimming as card fraud. Every pre-ordered transaction is expired immediately after predened set-up time while all input personal banking data into mobile is encrypted. Therefore customers are free from the threats of the possible fraud.

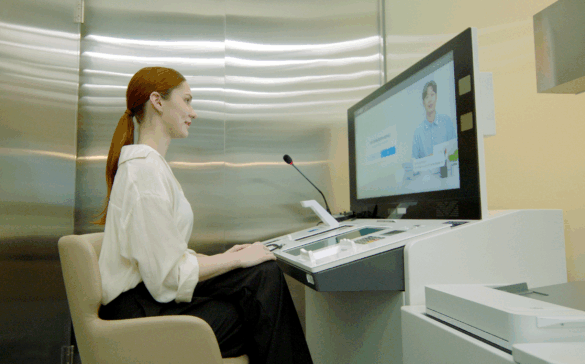

INNOVATIVE DESIGN

The simple design with 10”1 touch display presents more intuitive look and feel to customers. The innovative design of MoniValue100 makes customers to intriguingly touch, experience and get inspired. MoniValue100 provides customers with a new, complete and convenient self-service experience.

Full Specifications

- Height: 1,326.7mm (52.2“)

- Width: 440mm (17.3“)

- Depth: 829mm (32.6”)

- Weight: 393kg (886.42 lbs)

- Temperature 0°C ~ 40°C (32°F ~ 104°F)

- Humidity 25% ~ 85%

- Microsoft Windows® 10

- Hyosung BlueVerse™ XFS

- 10.1 inch display

- Lead-through Indicator

- Contactless card reader (Integrated NFC reader via card, smartphone or smartwatch)

- Cash Dispenser

- Maximum fill level 346mm per cassettes

- Configurable denomination

- Up to 5 cassettes

- Bundle present / retract

- Dispense up to 50 notes per transaction

- Safe : UL291 Level 1 (CEN option)

- Lock : Electronic lock,

Mechanical combination lock - Sensor : Alarm (Heat & Seismic),

Door sensor - Security camera (Face & Hand)

- MoniGuard endpoint security software

- AC100 ~ 240V, 50 ~ 60Hz

- Backup battery

- Barcode reader

Related Products

MV400

MV400 is an intelligent and powerful card issuing kiosk, that delivers fast, secure and personalized card issuing service. The MV400 offers proven reliability, easy operation, and less maintenance.

Related Experiences

Banking Experiences Designed for Branches & Stores

Elevating the financial world by enabling more efficient operations and convenient services with our best-in-class ATMs and self-service solutions.

Self-Order & Checkout Experiences

Reimagining human experiences at self-order and self-checkout moments, so they are more fluid, more seamless, and more equitable.

Related Contents

Redefining Next-Generation Branch Innovation: Self-Service Technology

Bank branches have long been established as a representative channel for financial services. However, the spread of digital banking and changes in customer behavior, expectations, and approaches are redefining the role of physical branches. Unique functions such as complex financial consultations, document processing, and large cash transactions are difficult to fully replace with digital channels, […]

Shared ATMs – A New Model for Europe

Shifting Branch and Cash Landscape Europe The French banking landscape has shifted dramatically in recent years. According to recent surveys, the closure of bank branches is accelerating throughout France and much of the world. When asked, the primary reason cited by financial institutions is the drop in footfalls and the rise of digital banking. In […]

How Gaming Venues Are Driving Efficiency, Security and ROI with Retail Cash Recyclers

Cash is Still King – But Smarter Management Is Now a Must Cash remains central to many retail and hospitality venues across Australia and New Zealand. From the gaming floor to the bar, it’s still the preferred form of payment for many patrons. But behind the scenes, managing that cash comes with significant operational complexities […]