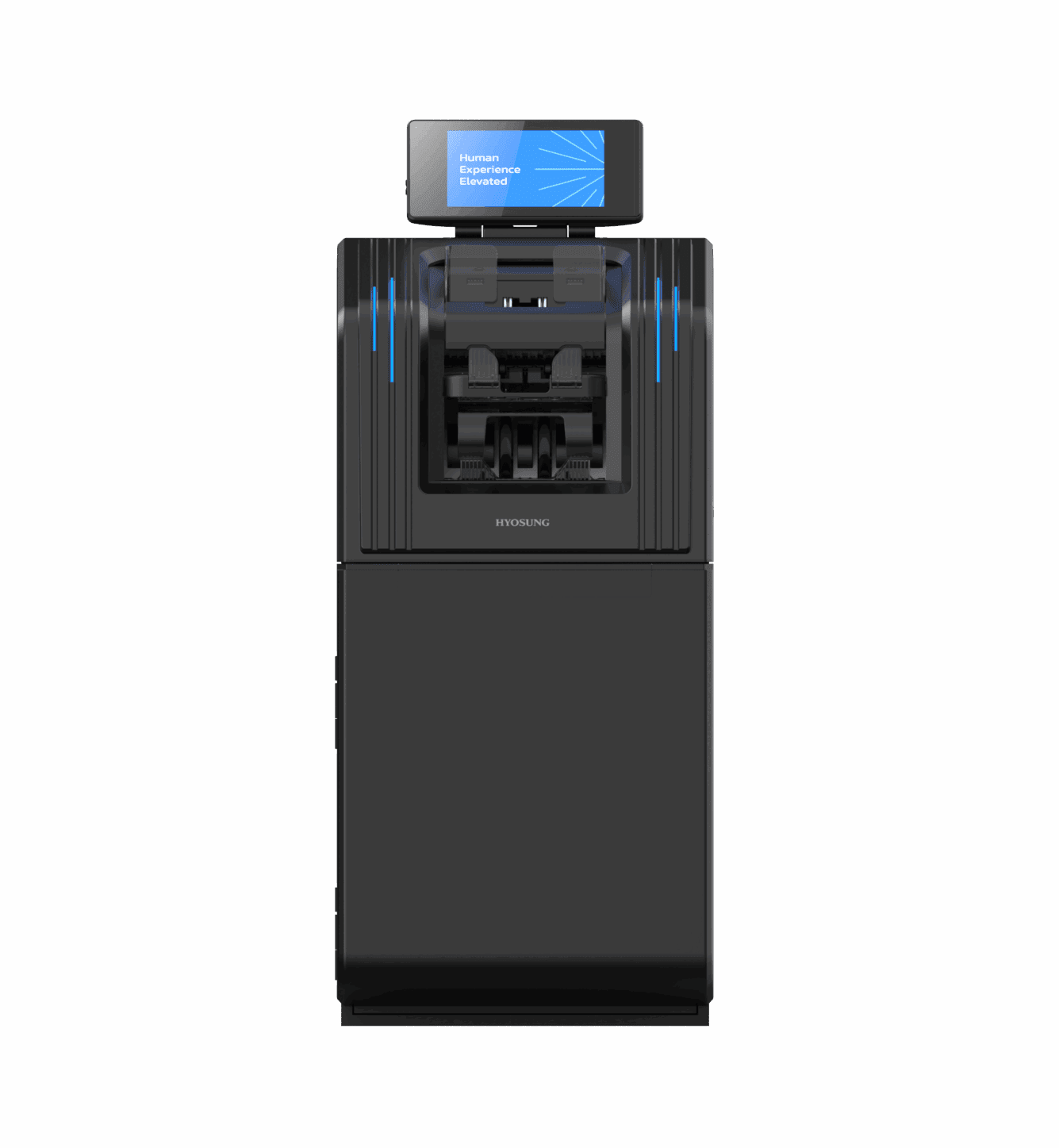

FEATURES

Advanced Cash Recycling

The MS500E comes equipped with our powerful cash recycling technology, allowing the same deposited notes to be reused for future dispense transactions.

Self-Audit & Cash Counting

The MS500E can verify and automatically track all notes in or out of the device ensuring maximum security and accuracy in cash handling.

Multi-denomination Support

With numerous large cash cassettes, the MS500E is capable of not only storing a large quantity of notes but also up to 6 different types of denominations.

Secure Cash Transfer

Our external transit cassette dramatically reduces cash exposure and is interchangeable with other Hyosung products. Tellers can load and remove cash from the recycler without opening the safe, securely transfer cash in the branch, the cassettes are easy to repair, operate and replace.

Full Specifications

- Height: 894mm (35.2“) with monitor

675mm (26.6“) under counter - Width: 430mm (16.9“)

- Depth: 997mm (39.2“)

- Weight: 311kg (685.6 lbs)

- Temperature : 5°C ~ 40°C (41°F ~ 104°F)

- Humidity 25% ~ 85%

- Microsoft Windows® 10

- 8” LCD Touchscreen

- Display unit status: note counting, and guidance messages

- Error and jamming point display

- Cash Recycling

- Continuous feed input module

- Supports up to 6 denominations

- 6 recycling cassettes, plus 2 drums

(1 Reject and 1 Overflow)- Split Cassette – Top: 100mm capacity, Bottom: 115mm capacity

- Reject Drum – 600 note capacity

- Cash Handling Speed

- Deposit: 8 notes/second (Max. 10 notes/second)

- Dispense: 8 notes/second (Max. 10 notes/second)

- Safe: UL291 Level-1

- Sensor: Safety Door

- Temperature, vibration sensors (optional)

- Front Access

- State of health indicators for all modules

- AC 200 ~ 240V ± 10% / 9.0A

- Secure Cash Transfer

- Securely moves cash within branch or among different locations

- External transit cassette (optional)

- Interchangeable with other Hyosung cash recyclers and branch transformation devices

- Securely moves cash within branch or among different locations

- Counting with note validation

- Note serial number recognition

- Fitness sorting

- Ambient LED light (optional)

Related Products

MS500

The MS500 is a digitally secure, fast and feature-rich cash recycler for financial institutions. The MS500 modular design and high capacity cassettes drive Hyosung’s industry-leading availability and serviceability.

MS500S

The MS500S delivers all of the functionality of the MS500 standard except, in a small package. Features such as transit cassette, self-audit, and continuous feed are all included in this mini powerhouse.

Related Experiences

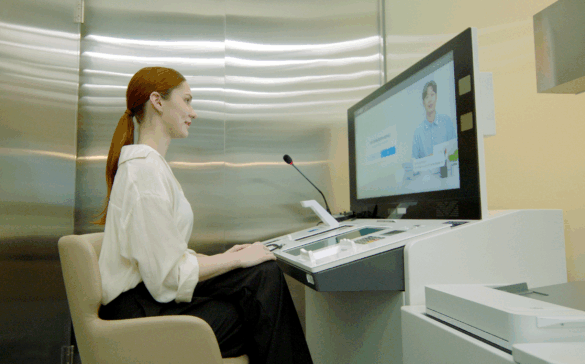

Banking Experiences Designed for Branches & Stores

Elevating the financial world by enabling more efficient operations and convenient services with our best-in-class ATMs and self-service solutions.

Self-Order & Checkout Experiences

Reimagining human experiences at self-order and self-checkout moments, so they are more fluid, more seamless, and more equitable.

Related Contents

How AI is Powering the Next Generation of ATMs

As the ATM and cash landscape continues to see drastic change and digital banking accelerates, the role of the ATM is being fundamentally reexamined. Once viewed as a simple transaction device, the ATM is now positioned to evolve through the application of artificial intelligence (AI) into a strategic extension of the bank’s digital and physical […]

Redefining Next-Generation Branch Innovation: Self-Service Technology

Bank branches have long been established as a representative channel for financial services. However, the spread of digital banking and changes in customer behavior, expectations, and approaches are redefining the role of physical branches. Unique functions such as complex financial consultations, document processing, and large cash transactions are difficult to fully replace with digital channels, […]

Shared ATMs – A New Model for Europe

Shifting Branch and Cash Landscape Europe The French banking landscape has shifted dramatically in recent years. According to recent surveys, the closure of bank branches is accelerating throughout France and much of the world. When asked, the primary reason cited by financial institutions is the drop in footfalls and the rise of digital banking. In […]