As the financial world continues to evolve, one trend is becoming increasingly clear: the number of ATMs is declining. From high streets to supermarkets, cash machines are disappearing at a rapid pace. But what does this mean for consumers, businesses, and the future of cash?

The Decline of ATMs: A Global Shift

Across the globe, we’re seeing fewer ATMs in public spaces. Supermarkets that once hosted multiple machines now offer just one. Entire high streets are losing their cash access points. This shift is driven by a combination of changing consumer habits, rising operational costs, and the closure of physical bank branches.

Despite changes in consumers’ payment habits, cash usage remains significant. Many consumers still depend on cash—whether for budgeting, accessibility, or reliability. However, the convenience of cash for consumers is increasingly at odds with the cost of maintaining cash infrastructure for banks and service providers.

Efforts to modernize cash access are complicated by varying levels of infrastructure, regulatory environments, and market readiness. Some regions are well-equipped for innovation, while others face technical and legislative hurdles that slow progress.

Automation Takes Centre Stage

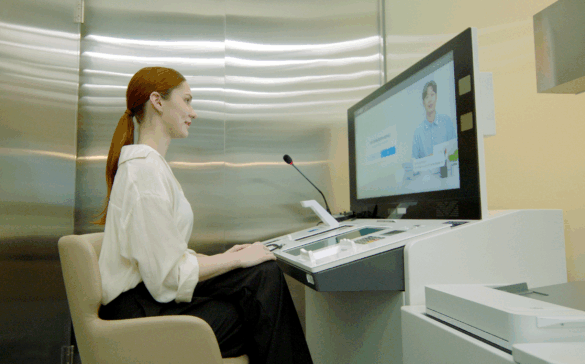

One of the key drivers reshaping how cash is supplied to consumers is the widespread closure of bank branches. As physical locations disappear, banks and other Financial Institutions are turning to automation and new technology in Self Service to maintain service levels. New self-service technologies—such as cash recycling—are becoming essential tools for delivering efficient, cost-effective customer experiences. These devices change the cash eco-system and deliver opportunities to reduce the cost to serve and enhance the potential to have a presence whether that is in a bank, supermarket or other shared location. Whatever the location the benefit is the improved availability of cash to the consumer.

Cash is Always Available

While digital and mobile banking continue to grow, cash remains a vital part of the financial ecosystem. Consumers value choice and flexibility, and this is no more evident than during system outages or cyber incidents. In these moments, cash provides a reliable fallback that ensures business continuity, and consumers being supported as the cash form of payment survives throughout these incidents.

Some governments have pursued digital-only strategies to replace cash, often with the goal of improving tax compliance or embracing innovation. However, many of these strategies are now being reconsidered. One notable example of regulatory repositioning is the UK Parliament’s introduction of the Financial Services and Markets Act 2023, aimed at safeguarding public access to cash. This legislation empowers the Financial Conduct Authority (FCA) to direct government-designated banks and businesses to address and resolve gaps in local cash access.

The move reflects growing recognition of cash as a critical component of financial inclusion, especially for vulnerable communities. The UK’s approach is part of a broader global trend, as governments worldwide enact legislative reforms to preserve and reinforce the role of cash in an increasingly digital financial ecosystem. These political, social, and economic shifts are prompting a more balanced approach—one that supports both digital payments and cash as complementary tools for payments.

The Power of Cash Recycling

Aside from political and social shifts, advancements in technology are another key area where access to cash is being improved. Cash recycling technology is transforming how financial institutions manage cash. By reusing deposited funds to meet withdrawal demand, these systems reduce the need for frequent replenishment, deliver lower operational costs, and improve service availability. These benefits create new opportunities for banks and business to streamline how they manage cash, helping to sustain its use and broaden access.

While new to some markets, cash recycling is already well-established in others and is proving to be a game-changer. Combine this with innovations like Secure Cash Transfer, and you have a suite of advanced cash technologies that are redefining the in-branch cash ecosystem—enabling financial institutions worldwide to better meet growing consumer expectations for secure, seamless access to cash.

Seamless Integration: Hyosung TNS’ Approach

At Hyosung TNS, we’re committed to bridging the gap between digital innovation and physical cash access. Our multi-channel, micro services solutions allow customers to perform transactions and continue to access cash services. Cash recycling can be a complicated shift in developing legacy IT solutions, but with our flexible approach to leveraging legacy core IT Platforms and implementing new advancements, Hyosung TNS can support innovation roadmaps to migrate an ATM to a new multi-function, cash recycling enabled touch point. This integrated journey enhances convenience, improves efficiency, and supports a more inclusive financial infrastructure.

Looking Ahead: A Balanced Future

As the financial landscape continues to shift, the need for accessible, reliable, and flexible cash services remains; ATMs can be repurposed to full function solutions. By embracing innovation and investing in smart infrastructure, we can ensure that consumers retain the freedom to choose how they manage their money—today and in the future.

Contact your local Hyosung TNS representative who can help you on your cash recycling journey.