With the rise of online banking and the widespread adoption of digital payments, it’s easy to assume that cash is becoming a thing of the past. But in reality, that couldn’t be further from the truth. Cash in circulation continues to grow globally, year after year, driven by ongoing demand for this trusted and tangible payment method. As more physical currency flows through the economy, it becomes increasingly important for businesses to adopt the right tools to manage, verify, and safeguard the growing volume of cash in circulation.

Why Cash is Growing Despite Digital Trends

So, what’s driving this increase in cash? Several key factors are contributing to this trend, including persistent inflation, expanding economic activity, and times of political, financial, or economic instability. As prices have surged—particularly in the aftermath of the COVID-19 pandemic—more banknotes have been printed to enable consumers to afford increasingly expensive goods and services. Additionally, global crises such as the pandemic and ongoing international conflicts have introduced heightened uncertainty, prompting many people to turn to cash as a reliable and familiar means of transaction. Whatever the reason, one thing remains clear: cash is not disappearing. In fact, nearly every major region worldwide has seen a steady increase in the volume of physical currency in circulation.

A Look at the Numbers

It’s noteworthy that the rise in cash circulation is not limited to cash-heavy developing regions; even more developed economies are seeing increases. Recent data from the US Federal Reserve reveals that since 2020, the total volume of US dollars has grown at an average annual rate of 2.8%, amounting to a total 10.1% increase in cash in circulation. Similarly, the European Central Bank reports that cash circulation in the eurozone has risen by an average of 3.6% annually since 2020, leading to a 15.3% total increase in cash volumes over the last five years. This data highlights the ongoing relevance and demand for cash, even amid the rise of digital payments. Despite the growing presence of digital alternatives, cash continues to prove its resilience, with many regions around the world continuing to increase the supply of this essential payment method.

Cash Automation: The Smart Response to Rising Volumes

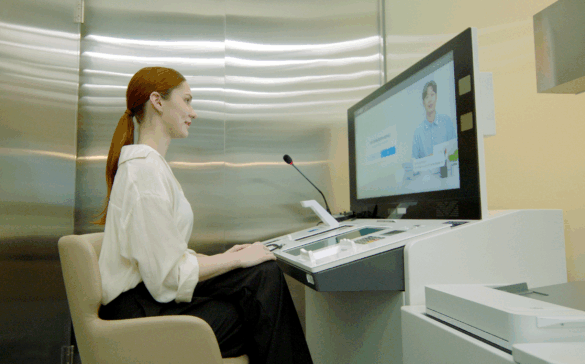

So, what does this mean for banks and retail businesses? With the increasing flow of cash, it’s crucial for these institutions to have the right systems in place to effectively manage and handle this growing volume of banknotes. The days of manual cash handling are behind us—self-service automation has revolutionized the speed and accuracy of cash counting and validation. By implementing devices such as ATMs, TCRs, cash recyclers, and other advanced technologies, both banks and retailers can significantly reduce cash handling time, enhance security, cut cash management costs, and most importantly, improve the customer experience.

These self-service devices are typically equipped with secure safes for storing cash and offer both deposit and dispensing capabilities, allowing for fast and accurate cash management. This not only relieves branch or store personnel from handling these transactions but also drastically reduces customer wait times. As a result, businesses can focus more on providing better customer service and creating richer, more meaningful experiences instead of being preoccupied with cash handling.

Interested in learning how to manage the growing influx of cash effectively? Reach out to your local Hyosung representative today to discover best practices for cash management and how the latest automated technologies can streamline your cash operations.