The expectations of consumers have changed dramatically. The pandemic has forced them to rethink how they carry out everyday activities—from getting cash at retail ATM machines to shopping for groceries. Businesses responded by providing their customers with more convenient options, like curbside pick-up. It’s unlikely that the world will ever go back. With the “new normal” here to stay, it is more important than ever to ensure that the retail ATM customer experience is as convenient, accessible, and safe as possible.

Factors that are driving the importance of the retail ATM customer experience

A survey by the Federal Reserve found that 65% of respondents ranked online banking as the most significant way they interact with their bank. ATMs ranked second at 62%. In the past, customers went to their branch for all their transactions. Now, they are more likely to conduct their real-world transactions at ATMs—including those in retail locations. Because of their growing importance, it is more important than ever to provide customers with a positive experience.

In addition, retail locations must consider the importance of reputation management. Digital communication channels such as social media and access to review websites like Yelp enable consumers to voice their opinions quickly and easily. Customers who have a poor experience at a retail location, because of outdated ATM technology, may express their displeasure online. Poor reputation management can cause a significant decline in foot traffic and reduce revenue.

Improving the retail ATM customer experience

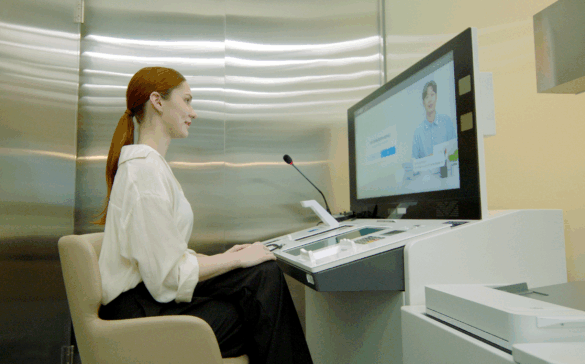

The good news is that there are multiple ways retail locations can improve customer experience. First and foremost, it is essential to upgrade outdated ATM machines with modernized ones that offer greater capabilities. For example, contactless transactions are popular among today’s consumers, as are features such as the ability to pay bills and deposit checks or cash.

Customers also want to use retail ATM machines designed with an intuitive layout; they don’t want to spend time hunting around for the correct option. Beyond installing ATMs with modern designs and greater capabilities, it is also essential to ensure that the machines never run out of cash and are kept in prime working order.

Partner with a proven retail ATM machine provider

At Hyosung America, we have painstakingly designed our entire suite of retail ATM machines with the customer experience in mind. By upgrading your fleet with Hyosung retail ATM machine solutions, you can delight your customers with greater convenience, stronger security, broader capabilities, and intuitive designs.

For decades, Hyosung ATMs have been on the leading edge of technological innovations in banking technology. Isn’t it time to give your customers what they want? Contact our team today to learn more about our ATM machines for retail businesses.