FEATURES

Advanced Cash Recycling

Reduce operating costs and increase availability

Large Cash Capacity

Reduce CIT frequency to optimize cash operations

Multi-Denomination Support

Split cassette technology allows for more diverse bill transactions

Weatherized Protection

Robust design and structure protect the ATM from the elements

Full Specifications

- Height : 1,610mm (63.4″)

- Width : 500mm (19.7″)

- Depth : 1,010mm (39.8″)

- Weight : 640 kg (1,411 lbs)

- Temperature : -35°C ~ 50°C (-31°F ~ 122°F)

- Humidity : 10% – 90%

- Microsoft Windows® Platform

- Hyosung BlueVerse™ XFS

- 15” Touchscreen (19″ optional)

- Card reader (Dip or Motorized) – EMV compliant

- Contactless card reader (optional)

- Encrypted Pin Pad (PCI Compliant)

- Audio jack

Bill Recycling Module

- 4 Recycling cassettes and 1 deposit cassette

- Large cassette: 430mm capacity

- Split cassette – Top: 100mm capacity

Split cassette – Bottom: 185mm capacity - Deposit cassette: 430mm note capacity – 1 Slot

(Retract: 65mm / Reject: 327mm – 2 Slots)

- Bundle up to 200 notes per transaction

- Safe: CEN-III EX-GAS

- Lock: Dial lock + Key lock

- Door sensor

- Security camera (face & hand)

- Front Access

- State of health indicators for all modules

- 3.1” graphical thermal receipt printer

- AC 100V ~ 127V±10% / 10.0A, 50 ~ 60Hz

- Battery backup (optional)

- Lead-through indicator

- Heater

- Cooler (optional)

- Barcode reader (optional)

- Securely moves cash within the branch or among different locations

- Transit cassette – Large: 430mm

Transit cassette – Standard: 320mm - Interchangeable with other Hyosung teller cash recyclers and branch transformation units

- Transit cassette – Large: 430mm

- Communication – TCP/IP

Related Products

Hyosung 8LA (MX8200S)

The 8LA modular design and high capacity drives Hyosung’s industry-leading availability and serviceability. The 8LA is designed to assist financial institutions in migrating teller transactions with the perfect blend of functionality and a modern design to complement evolving branch strategies.

Hyosung 9L

The Hyosung 9L combines state-of-the-art self-service capabilities with the latest advances in cash automation to deliver the pinnacle in branch transformation technology. A robust set of transactions provides access to a wide range of banking needs through Hyosung’s industry-leading core integration solutions.

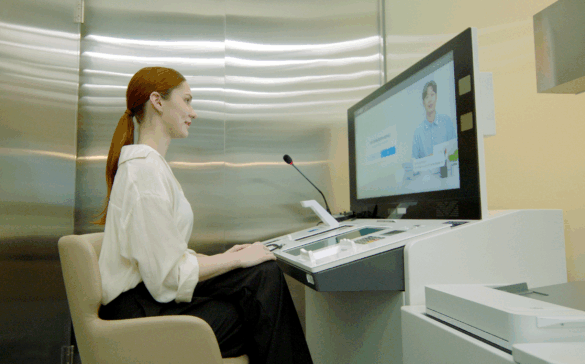

Related Experiences

Banking Experiences Designed for Branches & Stores

Elevating the financial world by enabling more efficient operations and convenient services with our best-in-class ATMs and self-service solutions.

Self-Order & Checkout Experiences

Reimagining human experiences at self-order and self-checkout moments, so they are more fluid, more seamless, and more equitable.

Related Contents

Redefining Next-Generation Branch Innovation: Self-Service Technology

Bank branches have long been established as a representative channel for financial services. However, the spread of digital banking and changes in customer behavior, expectations, and approaches are redefining the role of physical branches. Unique functions such as complex financial consultations, document processing, and large cash transactions are difficult to fully replace with digital channels, […]

Shared ATMs – A New Model for Europe

Shifting Branch and Cash Landscape Europe The French banking landscape has shifted dramatically in recent years. According to recent surveys, the closure of bank branches is accelerating throughout France and much of the world. When asked, the primary reason cited by financial institutions is the drop in footfalls and the rise of digital banking. In […]

How Gaming Venues Are Driving Efficiency, Security and ROI with Retail Cash Recyclers

Cash is Still King – But Smarter Management Is Now a Must Cash remains central to many retail and hospitality venues across Australia and New Zealand. From the gaming floor to the bar, it’s still the preferred form of payment for many patrons. But behind the scenes, managing that cash comes with significant operational complexities […]