FEATURES

SECURE CASH

Our external transit cassette dramatically reduces cash exposure and is interchangeable with other Hyosung products.

SELF-AUDIT

Say goodbye to time-consuming hand counting with Hyosung’s accurate and quick audit software.

CASH COUNT

Equipped with a built-in currency counter, making quick cash counts easy.

HIGH CAPACITY

The MS500S has a 10,000 note total capacity or about $200,000.

Full Specifications

- Safe: UL291 Level 1

- Temperature: 5°C~ 40°C (32°F – 104°F)

- Humidity: 25% ~ 85%

- Height: 695mm (27.4”) under desk

- Width: 428mm (16.85”)

- Depth: 1,176.3mm (46.3”)

- Weight: 420kg (926 lbs)

- Front access

- 7” wide LCD with touch screen

- Display unit status, note counting and guidance messages

- Error and jamming point display

- Microsoft Windows® 10

- Continuous feed input module Individual dispense and reject slots – 200-Note dispense slot – 30-Note reject slot• Cash handling speed – Deposit – 12 notes per second – Dispense – 12 notes per second – Note counting only – 20 notes per second

- 8 recycling cassettes plus 1 overflow cassette – 8 small-size recycling cassettes (100mm per cassette note capacity)* – 1 overflow cassette (295mm note capacity)*

- Self-audit capability

- Securely moves cash within the branch or among different locations – External transit cassette (295mm note capacity)* – Interchangeable with other Hyosung teller cash recyclers and branch transformation units

- Communication – TCP/IP

- In-use button

- Counting feature – With note validation

- Note serial number recognition

- Fitness sorting

- Multi-channel communications

Related Products

MS500

The MS500 is a digitally secure, fast and feature-rich cash recycler for financial institutions. The MS500 modular design and high capacity cassettes drive Hyosung’s industry-leading availability and serviceability.

Related Experiences

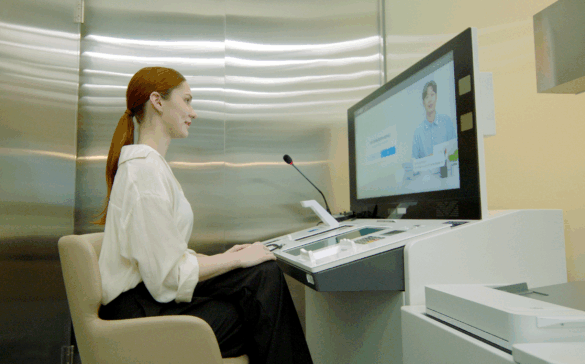

Banking Experiences Designed for Branches & Stores

Elevating the financial world by enabling more efficient operations and convenient services with our best-in-class ATMs and self-service solutions.

Self-Order & Checkout Experiences

Reimagining human experiences at self-order and self-checkout moments, so they are more fluid, more seamless, and more equitable.

Related Contents

Redefining Next-Generation Branch Innovation: Self-Service Technology

Bank branches have long been established as a representative channel for financial services. However, the spread of digital banking and changes in customer behavior, expectations, and approaches are redefining the role of physical branches. Unique functions such as complex financial consultations, document processing, and large cash transactions are difficult to fully replace with digital channels, […]

Shared ATMs – A New Model for Europe

Shifting Branch and Cash Landscape Europe The French banking landscape has shifted dramatically in recent years. According to recent surveys, the closure of bank branches is accelerating throughout France and much of the world. When asked, the primary reason cited by financial institutions is the drop in footfalls and the rise of digital banking. In […]

How Gaming Venues Are Driving Efficiency, Security and ROI with Retail Cash Recyclers

Cash is Still King – But Smarter Management Is Now a Must Cash remains central to many retail and hospitality venues across Australia and New Zealand. From the gaming floor to the bar, it’s still the preferred form of payment for many patrons. But behind the scenes, managing that cash comes with significant operational complexities […]