Solutions and Services

From banking to self-order & checkout, we make great human experiences. Learn more about our solutions designed for branches, retail, hospitality and travel, and tap into our managed services and professional services to take your game to the next level.

Banking Experiences Designed for Branches & Stores

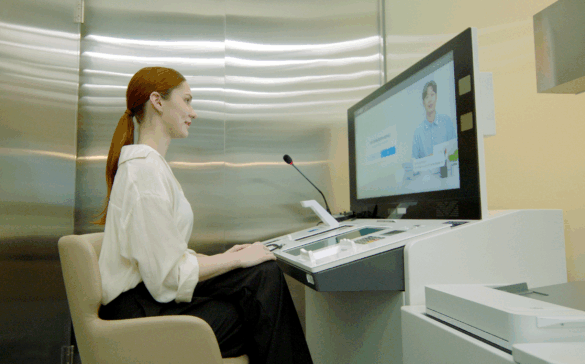

Our banking solutions provide the platform for financial service transformation. Whether you want to create convenient cash access, offer automated, full service banking, enable efficient and secure cash management or extend customer service hours with core integration and video-enabled teller and banker solutions, Hyosung TNS has you covered.

Self Order & Checkout Experiences

Our in-store point of sale solutions deliver frictionless shopping experiences while driving operational efficiency for any size retailer. Whether you want to enable self-service order/checkout, vending automation, efficient and secure cash management or drive foot traffic via alternative financial services, Hyosung TNS has you covered.

Managed Services & ATM As-A-Service

End-to-end ATM software management, hardware maintenance, monitoring and security turnkey services that allow you to maintain peace of mind while alleviating the burden of your ATM fleet management.

Featured Products

Hyosung 9L

The Hyosung 9L combines state-of-the-art self-service capabilities with the latest advances in cash automation to deliver the pinnacle in branch transformation technology. A robust set of transactions provides access to a wide range of banking needs through Hyosung’s industry-leading core integration solutions.

MS500

The MS500 is a digitally secure, fast and feature-rich cash recycler for financial institutions. The MS500 modular design and high capacity cassettes drive Hyosung’s industry-leading availability and serviceability.

Related Contents

How AI is Powering the Next Generation of ATMs

As the ATM and cash landscape continues to see drastic change and digital banking accelerates, the role of the ATM is being fundamentally reexamined. Once viewed as a simple transaction device, the ATM is now positioned to evolve through the application of artificial intelligence (AI) into a strategic extension of the bank’s digital and physical […]

Redefining Next-Generation Branch Innovation: Self-Service Technology

Bank branches have long been established as a representative channel for financial services. However, the spread of digital banking and changes in customer behavior, expectations, and approaches are redefining the role of physical branches. Unique functions such as complex financial consultations, document processing, and large cash transactions are difficult to fully replace with digital channels, […]

Shared ATMs – A New Model for Europe

Shifting Branch and Cash Landscape Europe The French banking landscape has shifted dramatically in recent years. According to recent surveys, the closure of bank branches is accelerating throughout France and much of the world. When asked, the primary reason cited by financial institutions is the drop in footfalls and the rise of digital banking. In […]