FEATURES

Paperless System

The future of banking with paperless operations revolutionize the transaction process for a truly seamless and clutter-free experience. By eliminating the need for paper, the Digital Desk empowers both tellers and customers to engage in a streamlined and efficient interaction, allowing them to focus on what truly matters – their banking needs.

Remote Banker

By embracing digitalization, the Remote Banker solution facilitates expedited processing of information and documents. By leveraging digital technology, banks can streamline their teller and banker operations with centralized hub, leading to cost reduction while anabling the simultaneous servicing of multiple branches.

Biometric Authentication

The incorporation of various biometric and other authentication methods, such as ID verification, palm vein scanning, fingerprint reading, and pin pad entry, empowers customers to complete transactions in their preferred manner while providing the bank with a wider range of options to streamline its processes.

Flexible Modularity

The Digital Desk’s flexible modularity enables banks to choose and integrate various components and functionalities based on their preferences and operational demands. Whether it’s the inclusion of specific hardware, software, or additional features, the Digital Desk can be easily customized and expanded to accommodate diverse banking experience environments.

Full Specifications

- Face Camera

- Temperature : 0°C ~ 40°C (32°F – 104°F)

- Humidity : 25% ~ 86%

- Height : 1,547 mm (60.91″)

- Width : 1,450 mm (57.09″)

- Depth : 1,153 mm (45.40″)

- Weight : 350 Kg (771.7 lbs)

- Front Access

- State of health indicators for all modules

- 43″ touch screen

- 15.6″ touch screen

- Laser printer

- ID scanner

- Handset

- Voice guidance

- Mobile phone charger

- Microsoft Windows® 10

- Proximity sensor

- EPP – PCI compliant (option)

- Palmvein scanner (option)

- Contactless reader – NFC integrated reader (via card, smartphone or smartwatch) (option)

- Card reader – Dip, EMV compliant (option)

- Barcode reader (option)

- 3D camera (option)

Related Products

Hyosung 8LA

The Hyosung 8LA's modular design and high-capacity drives our industry-leading availability and serviceability. The Hyosung 8LA is designed to assist financial institutions in migrating teller transactions with the perfect blend of functionality and a modern design to complement evolving branch strategies.

Related Experiences

Banking Experiences Designed for Branches & Stores

Elevating the financial world by enabling more efficient operations and convenient services with our best-in-class ATMs and self-service solutions.

Self-Order & Checkout Experiences

Reimagining human experiences at self-order and self-checkout moments, so they are more fluid, more seamless, and more equitable.

Related Contents

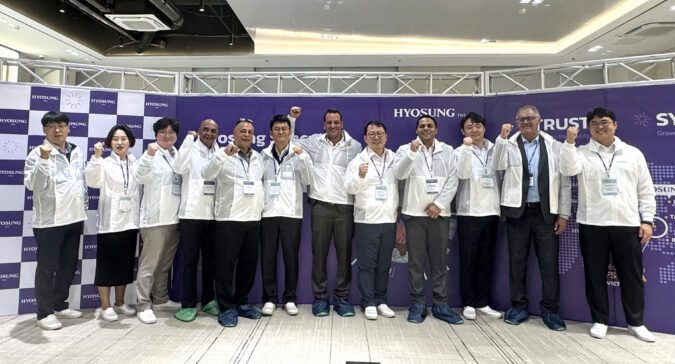

Driving Change in Southeast Asia with our Hyosung Sync: Growth Summit

On February 10th, Hyosung TNS hosted the second Hyosung Sync: Growth Summit at its HFS VINA manufacturing campus in Bac Ninh, Vietnam, bringing together partners from across Southeast Asia. Building on the momentum of the first summit, this gathering focused on branch transformation and the evolving role of physical banking channels in a rapidly digitizing […]

Hyosung Sync: Growth Summit Explores Innovation with MEA Partners

Hyosung TNS successfully hosted Hyosung Sync: Growth Summit on February 5th at its HFS VINA manufacturing facility in Bac Ninh, Vietnam, welcoming key partners from the Middle East & Africa (MEA) region. The summit focused on strengthening collaboration while exploring how software and integrated solutions can support the evolving banking landscape in the region. During […]

How AI is Powering the Next Generation of ATMs

As the ATM and cash landscape continues to see drastic change and digital banking accelerates, the role of the ATM is being fundamentally reexamined. Once viewed as a simple transaction device, the ATM is now positioned to evolve through the application of artificial intelligence (AI) into a strategic extension of the bank’s digital and physical […]